How Offshore Financial Investment Works: A Step-by-Step Break Down for Investors

Offshore financial investment offers an organized pathway for financiers seeking to enhance their financial strategies while leveraging global possibilities - Offshore Investment. The procedure starts with the cautious selection of a jurisdiction that lines up with a capitalist's goals, adhered to by the facility of an account with a trustworthy offshore establishment. This systematic approach not just allows for profile diversification but additionally requires continuous management to browse the complexities of worldwide markets. As we discover each action in information, it ends up being evident that understanding the nuances of this financial investment technique is vital for attaining optimum results.

Recognizing Offshore Investment

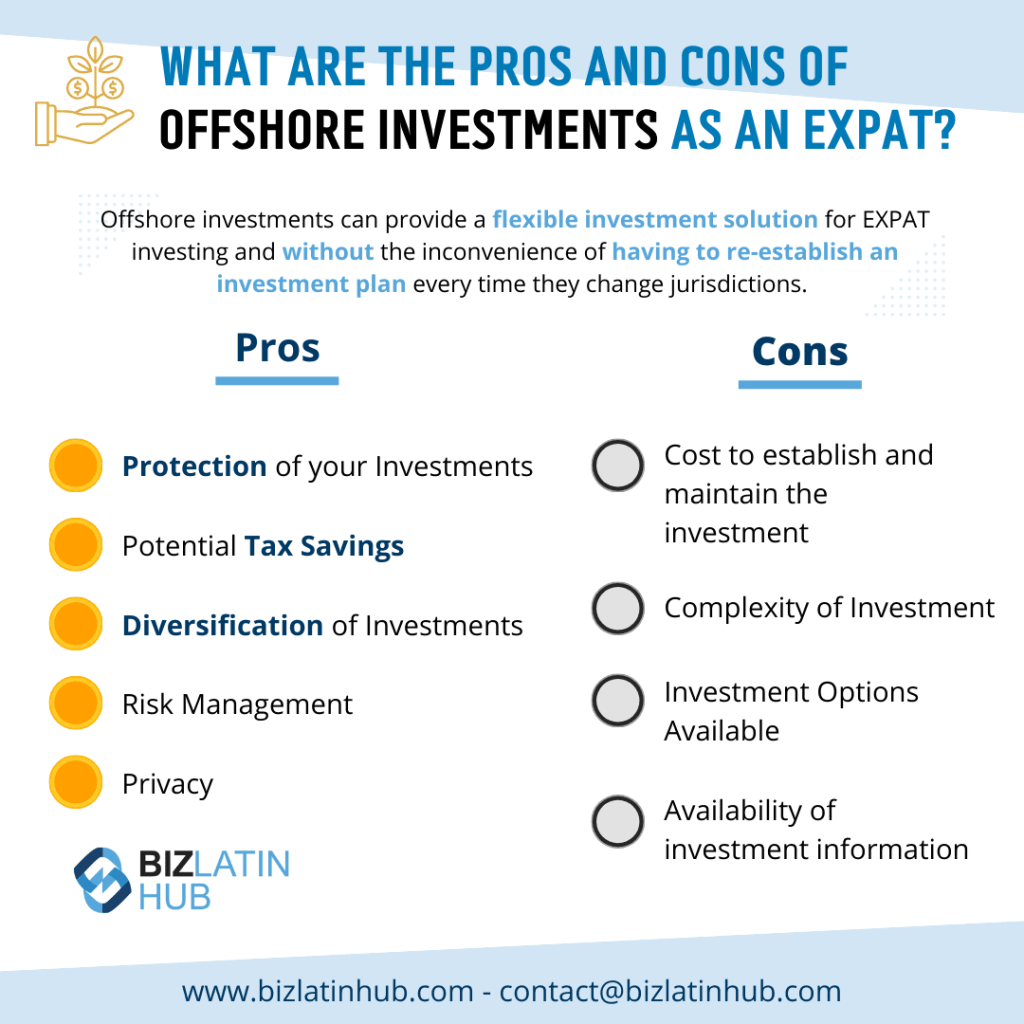

Recognizing offshore financial investment includes identifying the critical advantages it supplies to firms and people looking for to maximize their monetary portfolios. Offshore investments generally describe assets kept in a foreign territory, typically identified by beneficial tax regimens, governing settings, and personal privacy securities. The primary intention behind such investments is to boost funding growth, risk, and diversity management.

Investors can access a broad selection of economic instruments through offshore locations, consisting of stocks, bonds, mutual funds, and realty. These investments are commonly structured to adhere to local laws while providing flexibility in terms of asset allotment. Furthermore, offshore financial investment methods can allow people and services to hedge against domestic market volatility and geopolitical threats.

An additional key element of offshore investment is the possibility for boosted personal privacy. A thorough understanding of both the responsibilities and benefits connected with overseas investments is crucial for informed decision-making.

Advantages of Offshore Spending

Financiers often turn to offshore spending for its numerous advantages, consisting of tax obligation efficiency, possession defense, and profile diversification. One of the key advantages is the potential for tax optimization. Lots of overseas jurisdictions provide positive tax routines, permitting capitalists to legitimately reduce their tax obligations and make the most of returns on their financial investments.

Furthermore, overseas accounts can provide a layer of asset security. Offshore Investment. By putting possessions in politically steady territories with solid personal privacy regulations, investors can protect their riches from prospective legal insurance claims, lenders, or economic instability in their home countries. This form of defense is particularly appealing to high-net-worth individuals and business owners facing lawsuits threats

Furthermore, overseas investing promotes profile diversity. Accessing global markets enables financiers to check out opportunities in various asset courses, including realty, supplies, and bonds, which might not be readily available locally. This diversification can decrease overall profile threat and improve potential returns.

Eventually, the benefits of overseas investing are engaging for those seeking to maximize their monetary strategies. However, it is crucial for financiers to completely comprehend the implications and guidelines connected with offshore financial investments to ensure conformity and accomplish their financial goals.

Selecting the Right Territory

Picking the ideal jurisdiction for overseas investing is a crucial choice that can considerably influence an investor's monetary method. The right jurisdiction can provide different benefits, consisting of beneficial tax obligation frameworks, asset protection legislations, and governing environments that align with a financier's objectives.

When picking a jurisdiction, think about aspects such as the political security and financial health of the country, as these aspects can impact financial investment safety and security and returns. The legal framework surrounding foreign investments should be evaluated to guarantee compliance and protection of possessions. Nations understood for durable legal systems and transparency, like Singapore or Switzerland, typically impart higher confidence among investors.

Additionally, analyze the tax ramifications of the jurisdiction. Some countries offer eye-catching tax obligation motivations, while others may enforce rigid coverage needs. Understanding these nuances can help in optimizing tax obligation obligations.

Actions to Establish an Offshore Account

Establishing an overseas account entails a series of systematic steps that make certain conformity and protection. The very first step is picking a respectable overseas economic institution, which must be accredited and controlled in its territory. Conduct thorough study to why not check here examine the institution's trustworthiness, services provided, and customer reviews.

Following, gather the essential documentation, which typically consists of recognition, proof of address, and details regarding the resource of funds. Different territories may have varying demands, so it is crucial to confirm what is needed.

Once the documents is prepared, start the application process. This might include submitting kinds on the internet or personally, depending upon the establishment's protocols. Be prepared for a due diligence process where the financial institution will confirm your identity and analyze any type of possible threats related to your account.

After approval, you will certainly obtain your account information, enabling you to fund your overseas account. It is advisable to preserve clear records of all purchases and abide by tax obligation regulations in your house nation. Establishing the account correctly sets the structure for efficient offshore investment administration in the future.

Taking Care Of and Checking Your Investments

When an overseas account is effectively set up, the focus moves to handling and monitoring your financial investments properly. This vital stage involves an organized technique to ensure your assets straighten with your economic objectives and risk resistance.

Begin by developing a clear investment strategy that details your goals, Look At This whether they are outstanding conservation, revenue generation, or development. Routinely evaluate your profile's efficiency against these standards to assess whether changes are required. Making use of financial monitoring devices and systems can assist in real-time monitoring of your financial investments, supplying insights right into market patterns and asset allowance.

Involving with your offshore economic expert is crucial. They can provide know-how and advice, assisting you browse intricate regulatory environments and worldwide markets. Arrange regular testimonials to talk about performance, analyze market conditions, and alter your technique as essential.

Furthermore, remain notified about geopolitical growths and financial signs that may influence your financial investments. This aggressive strategy enables you to respond without delay to why not look here transforming circumstances, guaranteeing your offshore profile continues to be robust and aligned with your investment objectives. Ultimately, thorough management and continuous tracking are important for making best use of the benefits of your offshore investment technique.

Final Thought

In verdict, overseas investment supplies a critical opportunity for profile diversification and threat monitoring. Proceeded surveillance and cooperation with economic experts stay essential for keeping an active financial investment strategy in an ever-evolving international landscape.

Offshore investment provides an organized pathway for investors looking for to enhance their monetary approaches while leveraging worldwide possibilities.Understanding overseas investment includes recognizing the strategic advantages it uses to people and firms seeking to optimize their economic portfolios. Offshore investments commonly refer to assets held in a foreign jurisdiction, often characterized by positive tax obligation routines, regulative settings, and privacy securities. In addition, offshore investment methods can make it possible for people and companies to hedge versus residential market volatility and geopolitical risks.

Comments on “Why Offshore Investment Is an Efficient Method to Safeguard Your Retired Life Finances”